The divergence between semiconductor companies and B2B software is becoming hard to ignore. In this report, we summarize our takeaways from the reported earnings (C4Q22) and dive deeper into why we expect a 2H23 enterprise spend recovery.

Contents

- What is causing the wide divergence between semis and B2B software

- Have B2B software expectations finally re-set?

- Notes from BofA industrials conference

Semis vs. B2B Software

Semi-conductors tend to be an early indicator of economic recovery. This is due to their go-to market strategy (ie, distribution channels) which can amplify the impact on the way down and assist in the rebound.

Semiconductors have a vast array of applications, ranging from the consumer end-market, such as gaming, to the data center end-market, such as hyper-scalers. While the consumer end-market was the first to experience a downturn in the first half of 2022, the economic weakness quickly spread to other end markets, such as data centers, throughout the year.

Data center capex has been in the spotlight as several cloud vendors pointed to slower spending. But in some areas, such as accelerated computing, secular trends (eg, AI) started to offset the cyclical headwinds. Many investors think of semis as one end-market, but each individual product has its own supply/demand dynamics.

The demand for accelerated computing through GPUs is on the rise, with Artificial Intelligence (AI) and generative AI, in particular, driving strong demand for these products. This trend is already in motion and affecting results. Accelerated computing is a small portion of data centers today.

Our channel checks indicate that the capacity for high-performance computing is very tight. Following the OpenAI/ChatGPT announcement, many companies have incorporated AI functions into their products. These new features require compute power on the back-end. Even tech giants like Microsoft (NASDAQ:) are feeling the pressure of capacity constraints as they prioritize AI workloads. It’s clear that the demand for high-performance computing is soaring, and those who can provide it are poised for success.

While some investors were expecting challenges for Nvidia’s (NASDAQ:) Data Center segment, the surprise was that the company guided for strong QoQ growth in F1Q24. In addition to the secular trend towards accelerated computing, the company is benefiting from new product introductions (H100) which carry a price premium (1.5-2x ASP). Within only the second quarter of its availability, H100 sales have already surpassed those of A100, per Nvidia.

Unlike GPUs, the market for CPUs and memory is not as tight but is also starting to show signs of stabilization. Consequently, the outperformance of semis, specifically of GPU manufacturers makes sense. However, what is notable at this point in the cycle is how poorly other segments of the enterprise spend are performing, which is generally bottom 6 months after semiconductor companies.

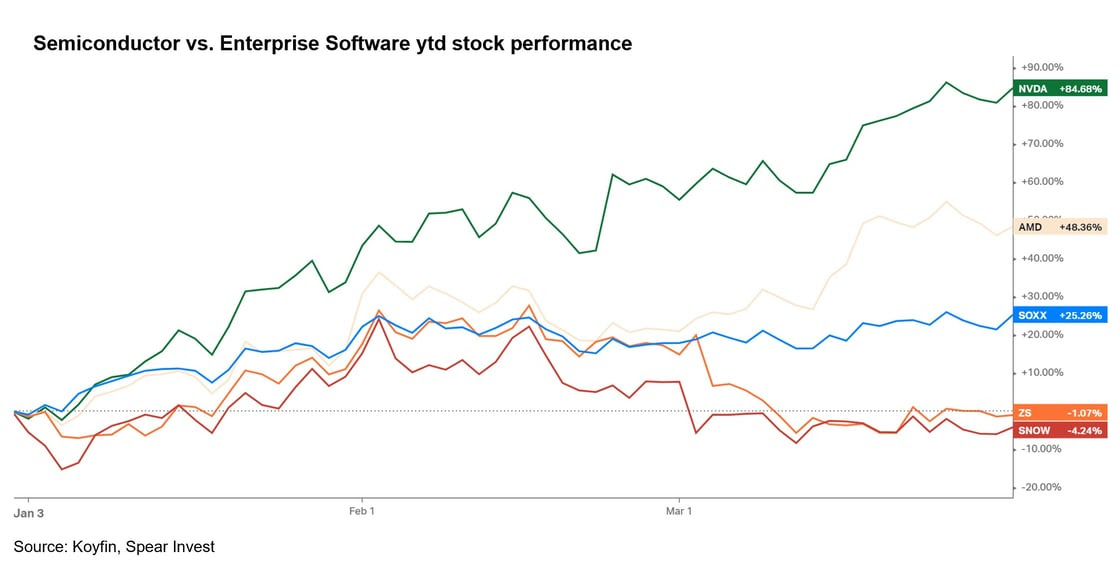

While Nvidia and Advanced Micro Devices (NASDAQ:) are up 85% and 45%, respectively, high-quality cloud infrastructure and cybersecurity companies such as Zscaler (NASDAQ:) and Snowflake (NYSE:) are trading near lows, despite potentially benefiting from similar secular trends.

B2B software expectations finally re-set?

The majority of our technology coverage universe reported earnings over the past month and the overall results were underwhelming. The theme across all reports was similar to last quarter: elongated sales cycles, customers only purchasing what they need, splitting up large deals in small pieces, etc.

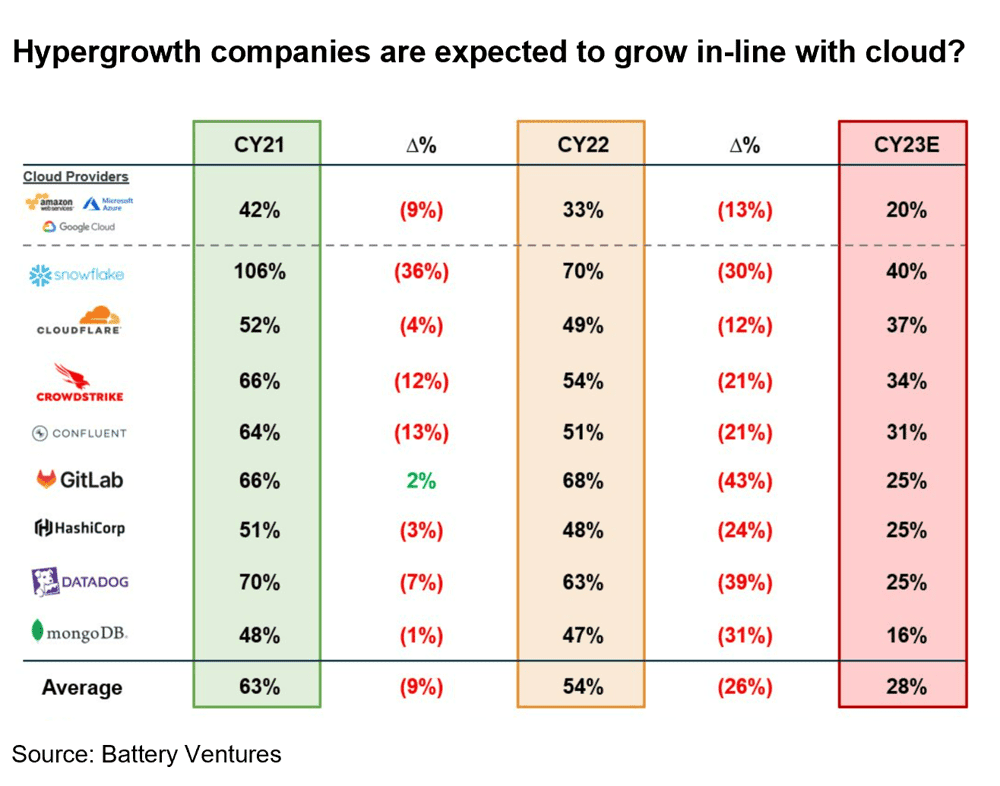

While most companies are expecting slower revenue growth going forward vs. 1-2 years ago, the magnitude of the slowdown was surprising. Hyper-growth companies that are at the forefront of innovation are now projected to grow

Most of the downside surprises this quarter came from the higher-quality companies that delivered strong results, but fell short of their usual beats/raise. Zscaler, Snowflake, Datadog (NASDAQ:), MongoDB (NASDAQ:), and Confluent (NASDAQ:), all fell in this category.

On the positive side, there were several trends in the C4Q22 report that we anticipate will persist throughout the year and beyond.

- Platforms performing better than point-solutions. While acquiring new logos was one of the significant challenges highlighted this earnings season, companies with multiple products or large installed bases were able to outperform as they were able to upsell their current customers.

- Cost cutting is just starting to impact results. The largest earnings surprises in technology more broadly came from companies cutting costs. We highlighted this trend going into this year and we are just starting to see it reflected in the results

- “Must-haves” performs better than “nice-to-haves”. Areas such as cybersecurity, were more resilient compared to other areas of enterprise spend where companies were able to optimize purchases such as cloud spend, DevOps, collaboration tools.

1. Platforms perform better than point solutions

Platforms, where the company can upsell its current customer base to new solutions that perform better than companies relying on new customers, especially for relatively bigger ticket items such as Zero Trust security. Palo Alto Networks (NASDAQ:) stood out driven by the company’s strong portfolio of “next-gen” solutions and large installed base. Crowdstrike (NASDAQ:), as well, reported a solid drive by the company’s ability to upsell more solutions and expand into SMBs.

As we move forward into the next 5 years in a tighter liquidity environment, we anticipate that M&A will play a crucial role in driving value creation for companies. In fact, we believe that M&A will be one of the key levers that will allow companies to stay competitive and relevant in an ever-evolving market. As such, companies with solid track records and proven integration playbooks will garner a premium multiple.

2. Cost cutting is just starting to impact results

While demand was muted across enterprises and consumer spending, companies were able to take cost actions that resulted in significant benefits.

Even high-quality companies with impressive double-digit revenue growth can benefit from a prudent cost-cutting measure such as a workforce reduction (up to ~10%). Such a reduction can significantly improve margins without negatively impacting long-term growth prospects. Notable examples of companies that we believe will successfully implement this strategy include Salesforce (NYSE:), HubSpot (NYSE:), Zoom (NASDAQ:), and Shopify (NYSE:).

Cost cutting above 10% of workforce is generally a sign of major turnaround and is significantly riskier. This strategy could be very successful (eg, Meta (NASDAQ:), Twitter), but it could also be a sign of challenging business models (Upstart (NASDAQ:), Opendoor (NASDAQ:), Carvana (NYSE:)).

3. “Must-haves” performed better than “nice-to-haves”

One theme that we heard throughout the earnings season was that companies spent money only where they had to. Consequently, the areas that were harder hit were DevOps, where companies purchased credits just for the current project. Cloud spending showed a similar trend, where companies looked to optimize their spend

While this trend of spending only where necessary may continue throughout the rest of the year, we believe that it will ultimately come down to the return on investment that these products provide. For the solutions that provide compelling ROI, more efficient deployment could mean less cyclicality in the future,

Enterprise spend could meaningfully pick up in 2H23

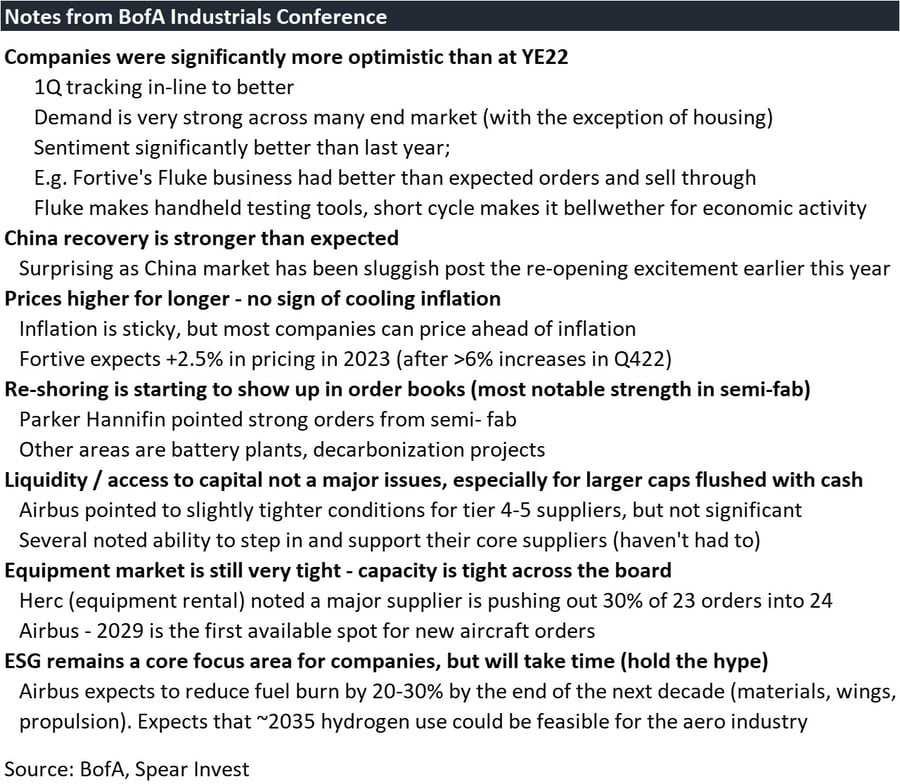

Last week we attended the BAML Industrials conference in London where we met with over 50 CEOs and CFOs of companies in a broad range of sub-sectors.

There was a clear change in sentiment since the end of 2022 when most management teams were pointing to some uncertainty. Most end markets are surprising to the upside with the exception of housing. Several companies noted that 1Q23 was tracking better than expectations. Moreover, the effect of re-shoring is starting to show up in order books with particular strength in semiconductor fabrication.

In addition, China’s recovery is showing incremental strength. This came as a surprise to us as the China market has been slugish post the re-opening excitement earlier this year.

Most companies are expecting inflation to remain sticky. But generally, companies can pass through price increases and even improve margins. Consequently, corporate earnings can act as an inflation hedge.

Many investors are still worried about a recession with tightening liquidity, inversion of the , implosion of the banking system, etc. However, we believe that this downturn is very different from the previous cycles. While most cycles follow a pattern, what differentiates this cycle is that there was no overcapacity going into the downturn. Consequently, even with tighter liquidity and slower economic growth, most end-markets are holding up very well.

We summarize our notes from the conference below:

Disclosures:

Views expressed here are for informational purposes only and are not investment recommendations. SPEAR may, but does not necessarily have investments in the companies mentioned. For a list of holdings click here. All content is original and has been researched and produced by SPEAR unless otherwise stated. No part of SPEAR’s original content may be reproduced in any form, without the permission and attribution to SPEAR. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any product or service for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on SPEAR’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice.

All statements made regarding companies or securities or other financial information on this site or any sites relating to SPEAR are strictly beliefs and points of view held by SPEAR or the third party making such statements and are not endorsements by SPEAR of any company or security or recommendations by SPEAR to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the market, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that SPEAR’s objectives will be achieved.

Further, there is no assurance that any strategies, methods, sectors, or investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. Click here for our Privacy Policy.