Pgiam/iStock via Getty Images

Investment Theme

The focus of this information-technology-centered software/service company is on the professional investment industry itself. Its website clearly states that only businesses providing investment services are of interest to Envestnet, Inc. (NYSE:ENV).

As has been indicated in prior articles, Market-Maker risk-avoidance requirements continually drive derivative market prices (even including this one’s), revealing the coming price range expectations of professionals. They are informed by over 100,000 world-wide wide-eyed and -eared MM employees on a 24x7x365 watch for changes in competitive circumstances. Which get immediately communicated to the home-base trading desks – principal customers of ENV.

Following an unchanging risk-minimizing portfolio management discipline, records can be kept of how insightful the maintained intelligences flow has been on ENV and each of thousands of subject stocks over decades of daily observations.

Description Of Our Company Of Interest

Envestnet, Inc., together with its subsidiaries, provides wealth management software and services in the United States and internationally. The company’s Envestnet Wealth Solutions segment offers Envestnet | Enterprise, which provides an end-to-end open architecture wealth management platform, as well as offers data aggregation and reporting, data analytics, and digital advice capabilities. The company’s Envestnet Data & Analytics segment offers Envestnet Data & Analytics, a data aggregation, data intelligence, and experiences platform that enables consumers to aggregate financial accounts within client applications, as well as provides clients the functionality to gather, refine, and aggregate various sets of consumer permissioned data for use in financial applications, reports, market research analysis, and application programming interfaces. Envestnet, Inc. was founded in 1999 and is headquartered in Berwyn, Pennsylvania.

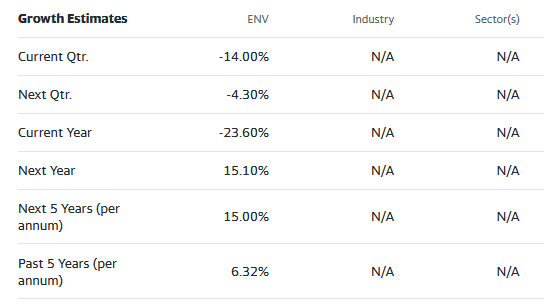

Source: Yahoo Finance

Yahoo Finance

These estimates come from less-intense general “street analyst” estimates made across hundreds or more subject companies, usually without specific things of value resting on the estimates offered.

What Are The Present Opportunities?

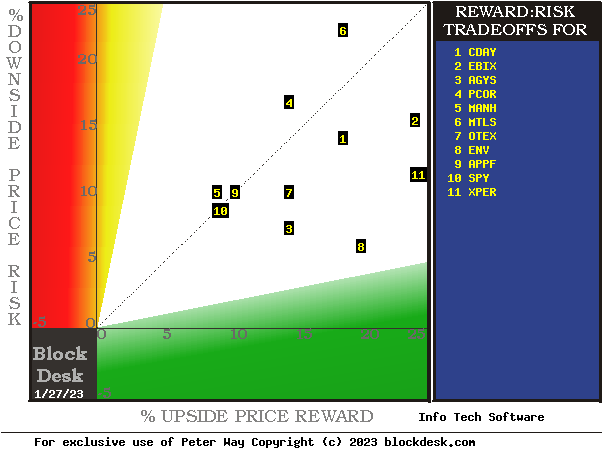

Figure 1 compares the prices and price-range extremes likely of Information Technology-provider stocks at this point in time, now that the Covid-19 pandemic has become relaxed as to voluntary home quarantine.

Figure 1

blockdesk.com (used with permission)

The tradeoffs here are between near-term upside price gains (green horizontal scale) seen worth protecting against by Market-makers with short positions in each of the ETFs, and the prior actual price drawdowns experienced during holdings of those ETFs (red vertical scale) . Both scales are of percent change from zero to 25%. Desirable locations are down and to the right.

The intersections of those coordinates by the numbered positions are identified by the stock symbols in the blue field to the right. The ‘market-average” notion SPDR S&P 500 Index ETF (SPY) at location [10] provides a sense of trade-off norms. ENV at [8] is our principal focus.

The dotted diagonal line marks the points of equal upside price change forecasts derived from Market-Maker [MM] hedging actions, and the actual worst-case price drawdowns from positions that could have been taken following prior MM forecasts like today’s.

This map is a good starting point, but it may only cover part of the investment characteristics that often should influence an investor’s choice of where to put his/her capital to work. Other considerations are indicated in Figure 2.

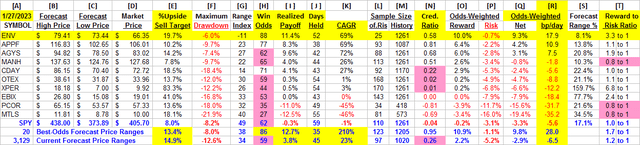

Figure 2

blockdesk.com (used with permission)

Because this article is an alert to be aware of a potential coming action-article rather than a presentation of the rationale for the action itself, there is little need for specific comparative data on alternative investment candidates. But it may be useful from a perspective point of view to understand what norms and extremes are frequently found.

The likely price range forecast for our subject of the moment, ENV, is in columns [B] and [C] with its current price in [D]. [E] tells the upside sizes of a price move [B] from [D]. The Range Index [G] measures the downside proportion of the whole [C] to [B] range lying between [D] and [C]. That proportion is reported in [G] as a % may be looked at as a potential forecast-risk “cost” of owning or being “long” the subject.

We use the Range Index as a perceived Reward~Risk gauge of coming near price extremes to assemble a sample of prior expectations among institutional investors and their professional agents, the Market-Makers. With a statistically-significant number of prior expectations a comparison of the subject investment candidate of the moment can be made to itself, historically, and used as a normalized projection of how often such prior projections became profitable outcomes in the sample [L] from the available 1261 forecast days [M] of the past 5 years.

In addition to the “Win odds” of [H] we can know the average size [I] of the net win and loss payoff outcomes of all [L] forecasts and use it in comparison to the comparison of the current [E] upside potential maximum likely price gain prospect [E]. that [E] vs. [I] ratio we regard as the “Credible ratio” shown in [N]. because [ I ] usually includes some loss experiences [N] typically is less than 1.0, but anything less than .70 is not encouraging.

A more universal “figure of merit” [fom] is obtained by win~loss odds weighting of [I] and [F] in [O] and [P] to get a net risk-adjusted reward [Q]. Recognizing the power of time in compounding, [Q] is adjusted by [J] to get the fom [R]. It is the potential “basis points per day” of return on investment from the current forecast.

Here that number for ENV is 17.9, which calculates to a CAGR of +69%. Compared to the current MM community expectations for the S&P 500 index ETF (SPY) at -5.6 of -1% CAGR that is pretty good. And compared to the 3,129+forecast population outlook for less than -6 bp/day, it is way above average.

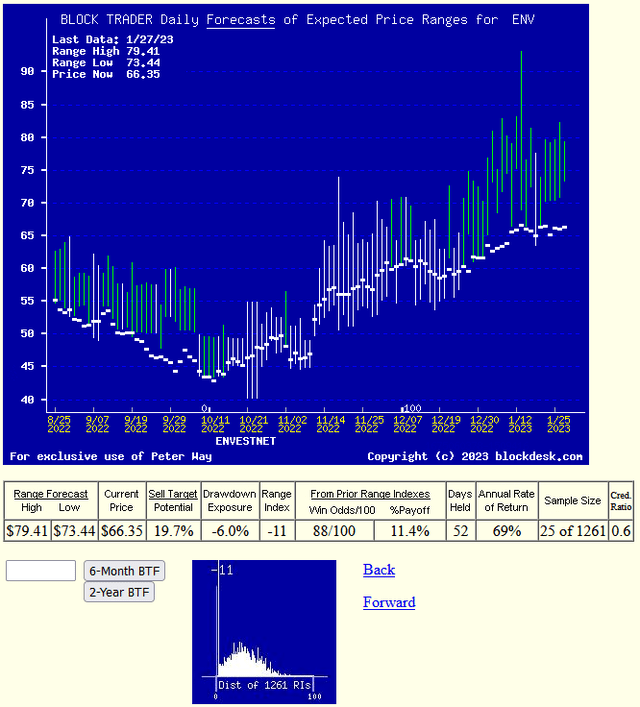

Recent Trend Of MM Price Range Forecasts For ENV

Figure 3 provides picture and analysis data of the past 6 months trend of MM daily price range forecasts. The vertical lines are forecasts, NOT “technical analysis” of past market actions. Each day’s range forecast is split into upside and downside prospects from the close price of the day of the forecast. This has not been an encouraging period for ENV and its information technology industry group, but the turn of market professionals for the better now appears to be under way.

Figure 3

blockdesk.com (used with permission)

Now the ENV Range Index of -11, with a Reward-to-Risk ratio of 3.3 to 1 is very attractive compared to anything else in Figure 2’s column T. And its prior 5-year experience of 22 profitable position forecasts out of 25, with a net profitability of all at +11.4% in 52 market days suggests a +69% CAGR

Conclusion

We believe that Envestnet, Inc., better than other info-tech stocks, will blossom well in the next 8+ weeks. Then earlier opportunity experiences will likely be revisited.