A revolution that started with a snowflake has turned into an avalanche, and could lead to a change in the way Americans pay for their services.

The software industry helped bring about the “subscription economy,” with businesses paying for cloud-delivered services on a monthly basis instead of buying boxed software just as consumers moved from buying DVDs to subscribing to streaming services. Now, software is moving in a different direction: charging for how much software a customer uses instead of a base fee every month.

“It’s as big a shift as from on-premises to cloud and subscription. And we expect that to continue,” Kyle Poyar, a researcher at OpenView Venture Partners and author of an influential report on usage-based pricing, told MarketWatch.

Government agencies and enterprise customers including Clorox Co. CLX

and CVS Health Corp. CVS

are paying for or considering business software as consumers pay a water bill. The practice was popularized in software by Snowflake Inc. SNOW,

a cloud-database software company that had one of the biggest initial public offerings of 2021, attracting investment even from Berkshire Hathaway Inc. BRK

BRK

despite Warren Buffett’s well-known aversion to young technology companies and their outsize valuations.

A balky economy, which has forced belt-tightening by companies small and large — including Facebook parent company Meta Platforms Inc. META,

Alphabet Inc.’s GOOGL

GOOG

Google, Amazon.com Inc. AMZN,

Intel Corp. INTC

and others — has hastened the jump to consumption pricing. The pay-as-you-go approach has been dismissed by some analysts as a liability for providers, since customers could quickly reduce spending during tight times, but subscription-model leaders Salesforce Inc. CRM

and ServiceNow Inc. now

are edging toward a consumption-based model with new offerings while reporting a slowdown in new business.

For more: Cloud software is a ‘fight for a knife in the youth,’ and Wall Street is souring on the one sector that was winning

“As the market becomes more uncertain, businesses invest in things they have more control over,” SAP SAP

executive board member Scott Russell told MarketWatch. “Everyone is focused on efficiency and automation.”

Phil Boland, manager of talent acquisition flexible workforce at Navy Federal Credit Union, has used a SAP product since 2016.

“Our consumption model usage rises and falls with market interest rates as we are a financial institution. As rates increase, our product demand typically diminishes, which in turn, decreases our hiring demand,” he told MarketWatch. “With the consumption model, this allows for a drop in cost commensurate with usage without reopening contracts. If your business has large swings in demand, the consumption model may work for your client.”

The changing economy

The jump to a subscription economy, one of tech’s most important developments in the past decade, has been fueled in large part by the rise of cloud computing and streaming services. Further influencing the change is the emergence of pricing professionals within companies such as Adobe Inc. ADBE,

Box Inc. BOX

and Splunk Inc. SPLK

who are tasked with optimizing software expenditures.

“Like the Liberty Mutual ad says, only pay for what you need,” says Constellation Research analyst Doug Henschen, summing up the trajectory of the software licensing deal — from the 5-year deal negotiated over a Martini lunch to the 3-year software -as-a-service (SaaS)/cloud deal to the current long-term consumption model of up to three years.

“This is causing the broader marketplace to change the way they think about pricing models,” AT&T Inc. Q

Chief Technology Officer Jeremy Legg told MarketWatch.

In a sense, it already has cellphone plans, cloud computing and streaming plans, but the trend could ripple into the broader economy beyond software. The way consumers pay their power bills could soon extend to other areas of the economy.

“If we distinguish between a pure metered/consumption model (ie the taxi meter) and a capacity model (pre-purchased ‘credits’ to spend how you want), I could see lots of things going the way of the capacity model,” Andy Macmillan, CEO of User Testing, told MarketWatch in an email.

“Maybe that’s how we buy media and TV in the future (ie $65 to spend on shows across any set of services or for the articles you read anywhere),” he said. “Car leases could go this way as well (pay for what you drive). I’ve also wondered if some of the direct-to-consumer brands for things like clothing could go this route. Sort of like Trunk Club, where you get a box of preselected clothes for purchase but rather you wear it once or twice and send it back. You pay for the usage of the clothes, not for the asset itself.”

“It gives users a better read on price point,” Macmillan said.

‘Saving money and ease of use’

Cloud stalwarts Amazon Web Services, Microsoft Corp.’s MSFT

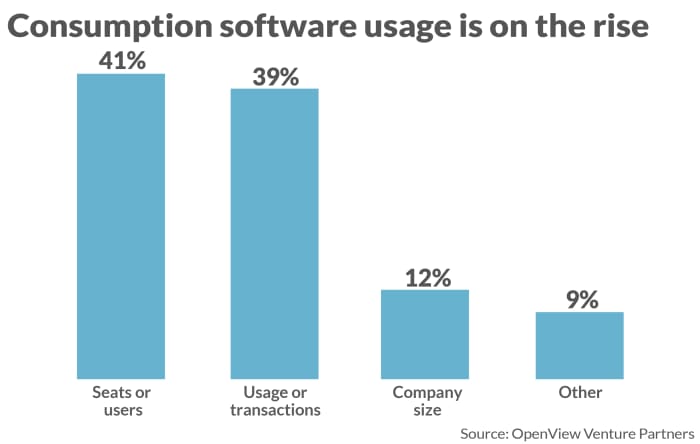

Azure and Google Cloud have charged customers based on how much server space is used for years. But that pricing model is spreading to more software services — 45% of SaaS providers now offer usage-based pricing, with that number expected to rise to 56% in 2023, according to the 2021 SaaS pricing survey from OpenView Venture Partners.

Also read: How Amazon created AWS and changed technology forever

“Out top two decision factors: Saving money and ease of use,” Becky Crow, director of accounting at Amarok, a maker of electric-fence security systems that switched from a subscription model to consumption approach this year, told MarketWatch.

The number might be even higher if some users weren’t dissuaded from using the service by continually climbing costs — also known as the “taxi-meter effect,” according to the OpenView report.

The trend is especially significant as the government, a colossal customer of software, is diving into the consumption model. Last year, the General Services Administration (GSA) continued to craft a draft policy that would let agencies buy cloud services “by the drink.” “GSA anticipates purchasing cloud computing on a consumption basis will increase competition, as the move toward commercial practices will encourage new entrants to the FSS program,” Jeff Koses, GSA’s senior procurement executive, wrote in a policy note, as reported by Federal News Network.

While software subscriptions are calculated based on seats or users; the consumption model is predicated on actual usage of computing power, storage, network capacity, and other measurable data. The trick with consumption is accurately tracking resource use within a fixed budget: You can overestimate or underestimate usage, industry analysts say.

Uncredited

Snowflake Chief Revenue Officer Chris Degnan considered in an interview with Bloomberg this year that it was “not easy” to sell consumption-based products to companies unfamiliar with the concept. Snowflake, which declined to comment for this article, was forced to build its own billing system, since most payment processors were geared toward handling subscriptions, Degnan said.

‘This is not a radical idea’

Now, other software providers are making the switch from a subscription-based service to consumption, including Twilio Inc.

TWLO,

New Relic Inc.

NEWR,

Tom Siebel’s C3.ai Inc. AI

and Autodesk Inc. ADSK.

A Greek chorus of tech executives told MarketWatch that usage-based pricing is becoming essential in their product tool kit, including — yes — applications.

“This is not a radical idea. Snowflake, Databricks , Azure, Google, AWS are all doing it,” Siebel told MarketWatch. As sales cycles slowed down, his enterprise software provider switched all new business to consumption pricing because it was easier for customers, cheaper and required less executive approval. “In a recession, you need to talk about pennies, not millions,” he said.

“It is very much a part of who we are,” David Trice, Honeywell Connected Enterprise’s HON

chief product officer, told MarketWatch, calling pay-as-you-use-software a staple in its contracts with warehouse customers, for example.

See also: Venture capital investors see an ‘R’ word coming for tech — and it isn’t just a recession

Last year, computer-aided design pioneer Autodesk introduced one-day “Flex” licenses that let users of AutoCAD pay $21 daily for the app rather than a standard $235 monthly subscription. Now, Autodesk customers typically blend both subscription plans and pay-as-you-use Flex apps.

“It’s a powerful tool for small businesses that can’t afford a full subscription to everything we do,” Autodesk CEO Andrew Anagnost told MarketWatch. “I think eventually, most everyone’s going to end up in some kind of consumption plan.”

Indeed, the Flex plan has allowed one customer to be able to add flexibility and affordably to their workforce.

“Subscription limits the user base. What happens is some of these applications are somewhat expensive and user-based, not project-based,” said Mark Schulz, director of CAD operations at Bolton & Menk Inc., an Autodesk customer that provides public infrastructure solutions for more than 100 communities in the upper Midwest. “The pay-as-you-go model is a huge plus, giving the app exposure to everyone.”