The Zacks Business-Software Services industry is benefiting from the heightened demand for digital transformation and the ongoing shift to the cloud. The growing automation of business processes across multiple industries and rapidly increasing enterprise data volumes are also driving the demand for business software and services. Industry participants like MSCI MSCI, Tyler Technologies TYL, Guidewire Software GWRE and ePlus PLUS are gaining from these trends.

Companies in this space had benefited from the pandemic-induced strong demand for cloud-based services from businesses looking to operate amid lockdowns. However, the growth rate has inched lower with the reopening of economies. Additionally, elevated operating expenses related to hiring new employees, and sales and marketing strategies to capture more market share are likely to strain margins in the near term.

Industry Description

The Zacks Business-Software Services industry primarily comprises companies that deliver application-specific software products and services. The applications are typically either license-based or cloud-based. The offerings generally include applications related to finance, sales & marketing, human resources and supply chain, among others. The industry consists of a broad range of companies offering a wide range of products and services, including business processing and consulting, application development, testing and maintenance, office productivity suits, systems integration, infrastructure services and network security applications. Some companies provide investment-decision support tools. Manufacturing, retail, banking, insurance, telecommunication, healthcare and public sectors are the primary end markets for industry participants.

5 Trends Shaping the Future of the Business-Software Services Industry

Transition to Cloud-Creating Opportunities: Companies in this industry have been gaining from the robust demand for multi-cloud-enabled software solutions, given the ongoing transition from legacy platforms to modern cloud-based infrastructure. These industry players are incorporating artificial intelligence (AI) in their applications to make the same more dynamic and result-oriented. Most industry players are now offering cloud-based versions of their solutions in addition to the on-premise ones, thereby expanding content accessibility. The enhanced interoperability features provide customers with differentiation and efficiency.

Subscription Model Gains Traction: The industry participants are modifying their business models to cope with clients’ shifting requirements. Subscription and term-license-based revenue pricing models have become very popular and are now replacing the legacy upfront payment prototype. Subscription-based business models provide increased revenue visibility and higher recurring revenues, which bode well for companies over the long haul. However, due to this transition, the top-line growth of these companies might be affected in the days to come as term-license revenues include advance payments, while subscription-based revenues are a bit delayed.

Continuous M&A to Expand Product Offerings: The players in this industry are resorting to frequent mergers and acquisitions to supply complementary and end-to-end software products. Nonetheless, increasing investments in digital offerings and acquisitions might erode the industry’s profitability in the upcoming period.

Strong IT Spending Forecast Bodes Well: The latest forecast for worldwide IT spending by Gartner is positive for industry players. Per the Gartner report, worldwide IT spending is anticipated to increase 5.5% year over year to $4.6 trillion in 2023 despite the continued global economic turbulence as organizations push for digital technology to optimize spend and transform the company’s value propositions, customer engagement and revenues. Spending across the software segment is projected to grow 12.3% this year as enterprises focus on automation, productivity enhancement and other software-driven transformation initiatives.

Elevated Operating Expenses to Hurt Profitability: To survive in the highly competitive business software market, each player is continuously investing in broadening its capabilities. The players in the space are aggressively investing in research and development to enhance their product portfolios. Moreover, companies are investing heavily to enhance their sales and marketing capabilities, particularly by increasing their sales force. Therefore, elevated operating expenses to capture more market share are likely to dent margins in the near term.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Business-Software Services industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #116, which places it in the top 46% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of the positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group’s earnings growth potential.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags the S&P 500 and the Sector

The Zacks Business-Software Services industry has underperformed the S&P 500 Index as well as the broader Zacks Computer and Technology sector over the past year.

The industry has declined 8.4% during this period, while the broader sector and the S&P 500 increased 11.1% and 2.2%, respectively.

One-Year Price Performance

Industry’s Current Valuation

Comparing the industry with the S&P 500 composite and the broader sector on the basis of the forward 12-month price-to-earnings, which is a commonly-used multiple for valuing business-software services stocks, we see that the industry’s ratio of 21.22 is higher than the S&P 500’s 18.76 but lower than the sector’s 24.60.

Over the last five years, the industry has traded as high as 38.27X, as low as 6.60X and recorded a median of 21.47X as the charts below show.

F12M Price-to-Earnings Ratio (Industry vs. S&P 500)

F12M Price-to-Earnings Ratio (Industry vs. Sector)

4 Stocks to Watch

MSCI: The company offers investment decision support tools, including indexes, portfolio construction and risk management products and services, Environmental, Social and Governance (ESG) research and ratings, and real estate research, reporting and benchmarking offerings.

MSCI is benefiting from the solid demand for custom and factor index modules, a recurring revenue business model and the growing adoption of its ESG solution in the investment process. MSCI’s expanding portfolio of climate tools is expected to drive the top line. Acquisitions have enhanced its ability to provide climate-risk assessments and assist investors with climate-risk disclosure requirements. Moreover, the strong traction of client segments like wealth management, banks, brokers and dealers is an upside.

Shares of this Zacks Rank #3 (Hold) company have increased 2.3% year to date (YTD). The Zacks Consensus Estimate for 2023 earnings has moved 3 cents north to $12.92 per share over the past 30 days. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

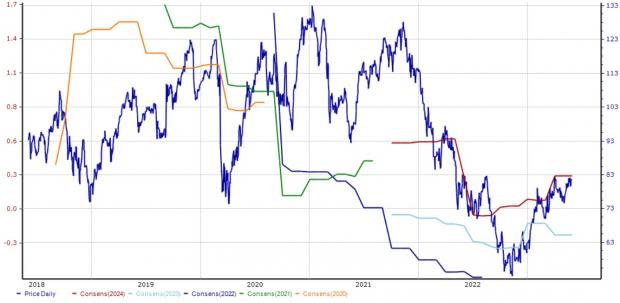

Price and Consensus: MSCI

Tyler Technologies: This Zacks Rank #3 company is a leading provider of integrated information management solutions and services to the public sector. The company serves its customers both on-premise and in the cloud.

Tyler is benefiting from higher recurring revenues, the post-acquisition contributions of NIC and the constant rebound of the market and sales activities to pre-pandemic levels. The public sector’s ongoing transition from on-premise and outdated systems to scalable cloud-based systems is an upside. The growing hybrid working trend is also driving the demand for its connectivity and cloud services.

Shares of this Plano, TX-based company have soared 22% YTD. The Zacks Consensus Estimate for 2023 earnings has remained unchanged at $7.58 per share over the past 60 days.

Price and Consensus: TYL

Guidewire Software: This San Mateo, CA-based company is a provider of software solutions for property and casualty insurers. The company’s solutions aid in reducing risks via increasing productivity, bringing speed to market, digital engagement and simplifying the IT infrastructure.

Guidewire is riding on higher subscription revenues, as seen in its fiscal fourth-quarter results. The company’s subscription-based offerings are gaining from the robust adoption of the InsuranceSuite Cloud platform. Further, its focus on enhancing the Guidewire Cloud platform with new capabilities is expected to boost sales of subscription-based solutions in the long haul. Guidewire’s cloud deployment partner, Amazon Web Services, is also gaining traction. Strategic acquisitions and collaborations, along with a less competitive market and a strong liquidity position, bode well.

This Zacks Rank #3 stock has rallied 29.8% YTD. The consensus mark for fiscal 2023 is pegged at a loss of 22 cents per share, unchanged over the past 60 days.

Price and Consensus: GWRE

ePlus: This Herndon, VA-based company organization enables to optimize their IT infrastructure and supply-chain processes by delivering world-class IT products from top manufacturers, professional services, flexible lease financing, proprietary software and patented business methods.

The company is benefiting from the increasing demand for work-from-home hardware and software, including PCs, tablets, connectivity, collaboration and security products, amid the rising trend of hybrid working. Moreover, the company’s strategy of acquiring regional solution providers is helping it grow across the higher-margin IT service market.

This Zacks Rank #3 stock has risen 12.7% YTD. The consensus mark for fiscal 2024 earnings has remained unchanged at $4.68 per share in the past 60 days.

Price and Consensus: PLUS

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MSCI Inc (MSCI) : Free Stock Analysis Report

Guidewire Software, Inc. (GWRE) : Free Stock Analysis Report

ePlus inc. (PLUS) : Free Stock Analysis Report

Tyler Technologies, Inc. (TYL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research